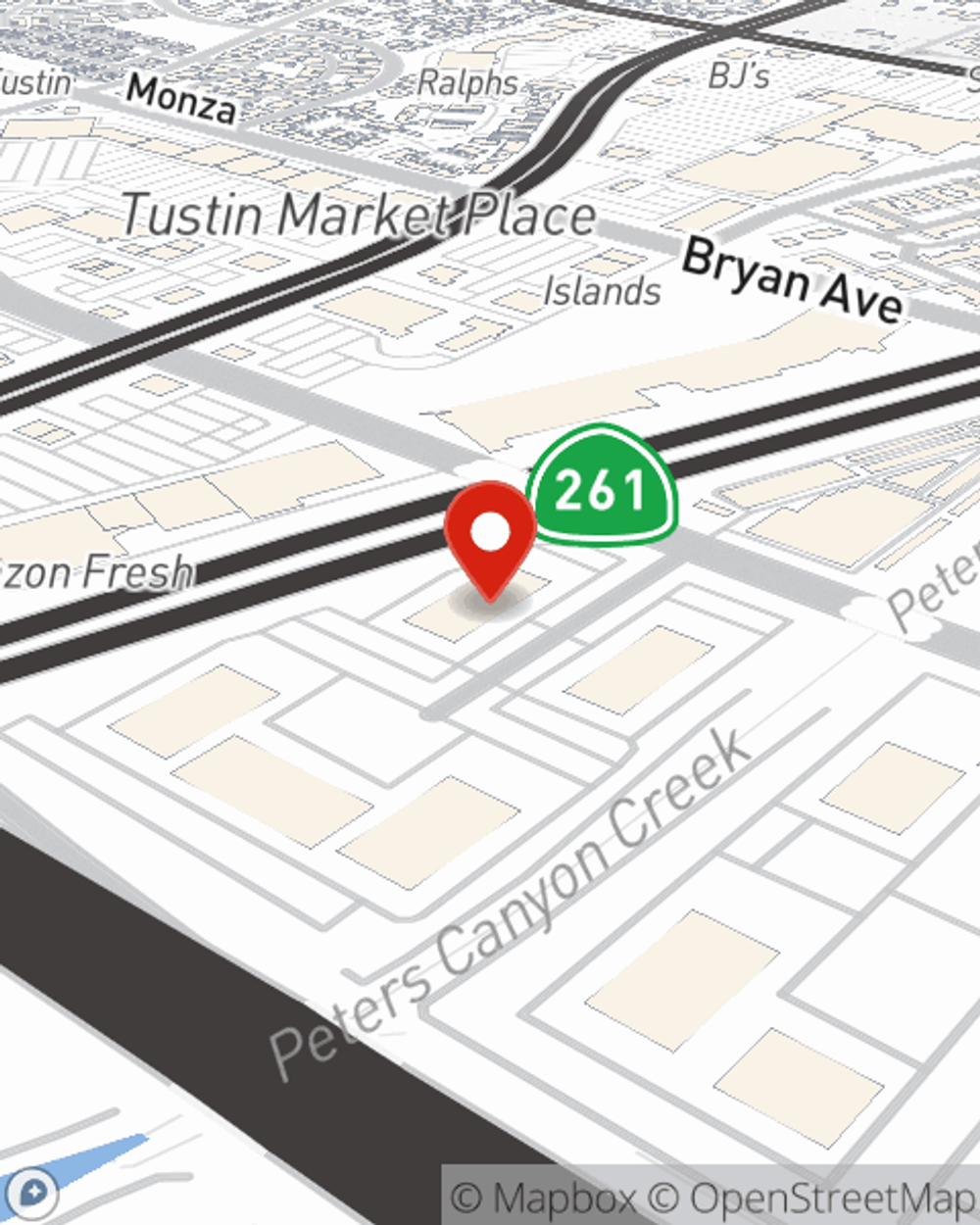

Business Insurance in and around Irvine

Looking for small business insurance coverage?

No funny business here

- Irvine

- Tustin

- Santa Ana

- Newport Beach

- Lake Forest

- Rcho Sta Margarita

- Orange County

- Laguna Niguel

- Laguna Hills

- Laguna Beach

- Laguna Woods

- Long Beach

- Corona

- Riverside

- Huntington Beach

- Fullerton

- Yorba Linda

- Anaheim

- Corona Del Mar

Insure The Business You've Built.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jim Canty help you learn about terrific business insurance.

Looking for small business insurance coverage?

No funny business here

Customizable Coverage For Your Business

State Farm has been helping small businesses grow since 1935. Business owners like you have counted on State Farm for coverage from countless industries. It doesn't matter if you are a real estate agent or an HVAC contractor or you own an ice cream shop or an acting school. Whatever your business, State Farm might help cover it with personalized policies that meet each owner's specific needs. It all starts with State Farm agent Jim Canty. Jim Canty is the agent who relates to where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to understand your small business insurance options

Visit the outstanding team at agent Jim Canty's office to uncover the options that may be right for you and your small business.

Simple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Jim Canty

State Farm® Insurance AgentSimple Insights®

Support small business in your community

Support small business in your community

Whether you tip more than usual, order takeout or delivery or buy gift cards, we review how to support small business.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.